NatWest has confirmed it will close its last remaining branch on Anglesey in September.

The banking giant will shut its Llangefni branch on Glanrhwfa Road on Thursday 4th September.

NatWest says a drop-off footfall is to blame - with over-the-counter transactions down by 55% in the last five years and 72% of its customers also using its online and mobile banking services.

Three branches in Holyhead, Menai Bridge and Amlwch were closed in June 2016.

NatWest says customers will still be able to access services in the town via their local Post Office and a community pop-up branch will be set up nearby following the closure.

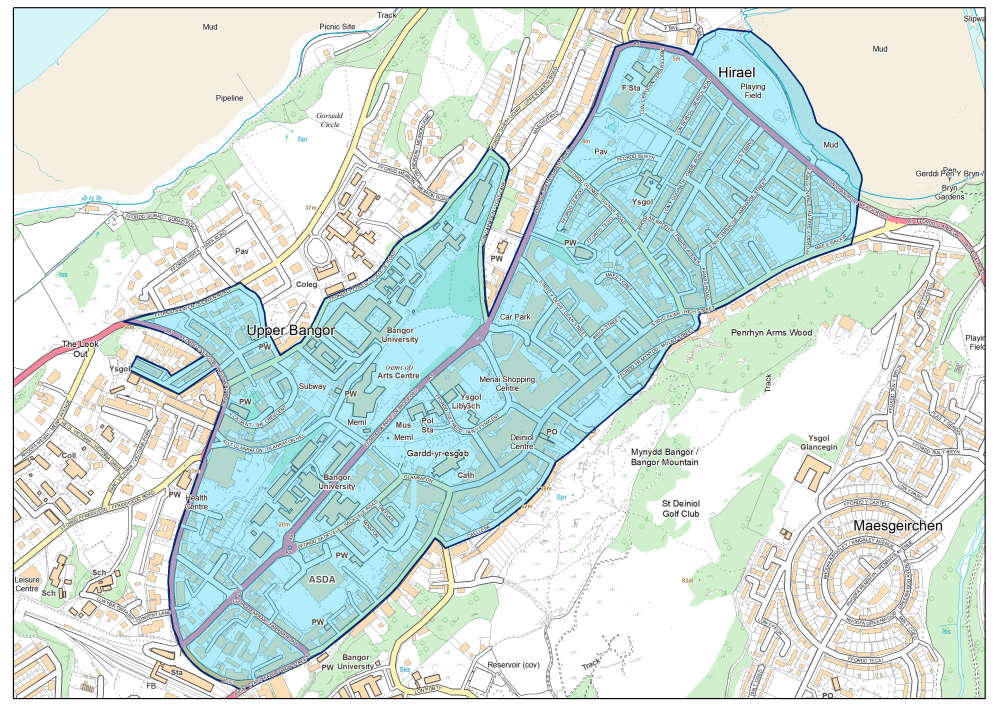

The nearest mainland branch in Bangor will remain open.

A NatWest spokesperson said: "Our customers are using digital banking more than ever before - over 80% of our active current account holders now use our digital services and over 97% of retail accounts with us are now opened online."

"Our customers appreciate the speed and convenience of digital banking for everyday transactions, and often, when it comes to making bigger, more complex decisions they value speaking to our skilled and experienced colleagues."

"Like any business, we strive to meet our customers' changing needs and expectations and we've been responding to the industry wide shift towards digital services by investing to broaden what customers can do themselves and to offer them greater personalisation. While we are increasingly engaging our customers digitally, our branch network remains important to us."

They added: "As we adapt our services to meet changing needs we may take the difficult decision to close or consolidate some of our branches. While we know that this is disappointing, we have carefully considered how best to invest to make sure we have a sustainable network for the future."

"We consider each branch individually and review a wide range of factors, including but not limited to, impact on customers, the level of financial vulnerability in the area, the nearest available branch, banking hub, Post Office and free ATMs and regular transport links."

"We're committed to ensuring the transition of UK banking services on to digital platforms is managed compassionately and we recognise that some people still need help to adapt, particularly our vulnerable customers. We are also committed to supporting our elderly customers, with almost half of over 70s with active current accounts now accessing digital banking."

"Our customer support specialists proactively contact branch users who we know may need additional support when a branch closes and where there's a need we install community pop-ups to help customers become familiar with alternative banking services."

Digital banking continues to provide new and inclusive ways of allowing the overwhelming majority of our individual and business customers, including the elderly and vulnerable, to bank with us in ways that they weren't able to before."

"But we know that a small number of people are not yet comfortable with it, which is why we are proactively reaching out to support them with this transition, having made over 200,000 calls last year. We also have experts that they can speak to for support and guidance."

Reacting to the announcement, Plaid Cymru leader Rhun ap Iorwerth described it as "deeply disappointing", following an "increasingly worrying and unacceptable trend of commercial banks turning their backs on customers in rural communities."

The Ynys Môn MS said: "We’ll make the case to NatWest to reverse its decision, as well as continue conversations with Link to ensure that no one is left behind because of this announcement."

Llangefni: major gas works underway

Llangefni: major gas works underway

DWP manager fined for selling illegal tobacco

DWP manager fined for selling illegal tobacco

Cemaes Bay man admits drug dealing

Cemaes Bay man admits drug dealing

Bangor man jailed for controlling behaviour

Bangor man jailed for controlling behaviour

Bangor protection order extended

Bangor protection order extended